We tracked 52 races in the SC House of Representatives in Tuesday’s election. Unofficial results are detailed below:

Budget Puts Dollars to Work for SC

The FY22-23 budget benefitted from the state’s unprecedented revenue growth that continues to defy expectations. Legislators had a record amount of revenue to allocate, and they chose to invest in tax reductions, reserves – and roads.

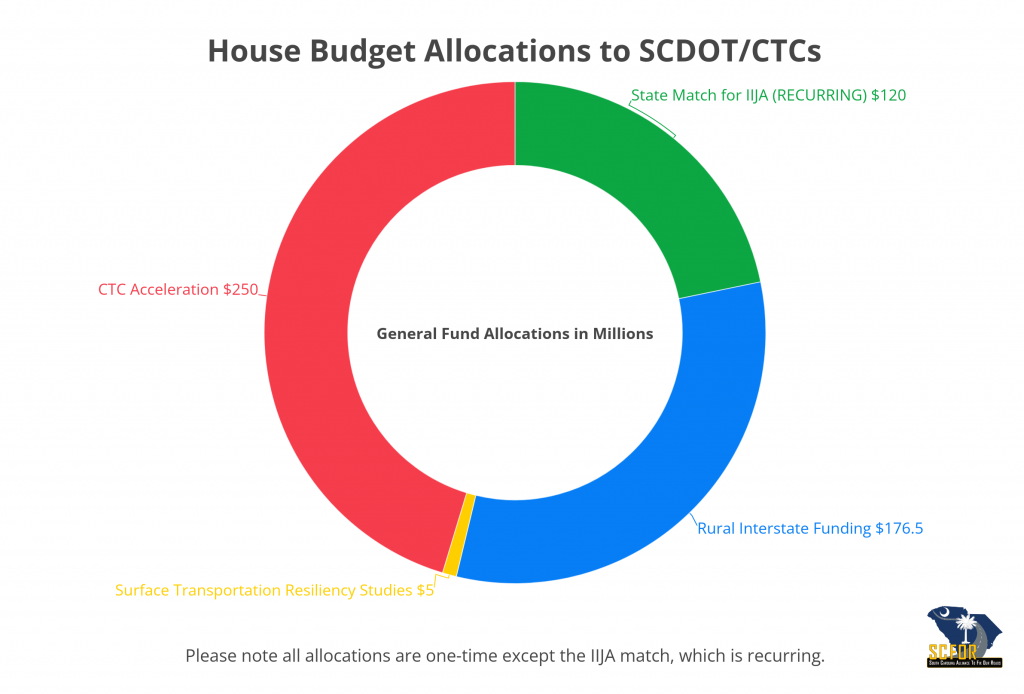

Specifically, the budget includes one-time and recurring allocations to accelerate projects and match federal funds.

Thanks to these investments to match federal dollars, South Carolina is poised to take advantage of every opportunity available through the federal Infrastructure Investment & Jobs Act (IIJA). These funds also ensure that South Carolina does not leave any federal dollars on the table.

These new federal funds (along with state match) will bolster the state’s 10-year plan by filling gaps in critical areas, including programs to address non-interstate congestion, closed and load-restricted bridges, traffic safety, and more.

The budget also provides funding for rural interstates to help accelerate projects in the pipeline aimed at moving people and freight safely and efficiently. In addition, the allocations to the County Transportation Committees (CTCs) will boost funding for every county to help tackle repair work.

In all, transportation infrastructure received approximately $1 billion this year through American Rescue Plan (ARPA)* and budget allocations.

![]() *The ARPA allocation will be used to accelerate the widening of I-26 between Columbia and Charleston. This dangerous and notoriously unreliable section of interstate is among the top priorities of the state’s rural interstate freight program, and this investment will accelerate this project by six years. Learn more here.

*The ARPA allocation will be used to accelerate the widening of I-26 between Columbia and Charleston. This dangerous and notoriously unreliable section of interstate is among the top priorities of the state’s rural interstate freight program, and this investment will accelerate this project by six years. Learn more here.

2022 Primary Elections

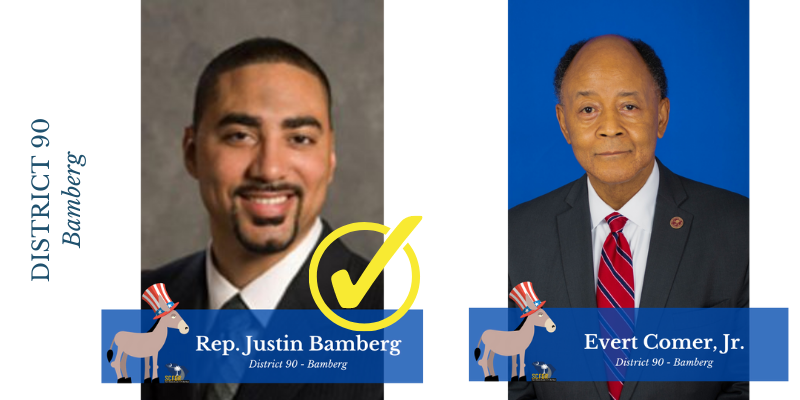

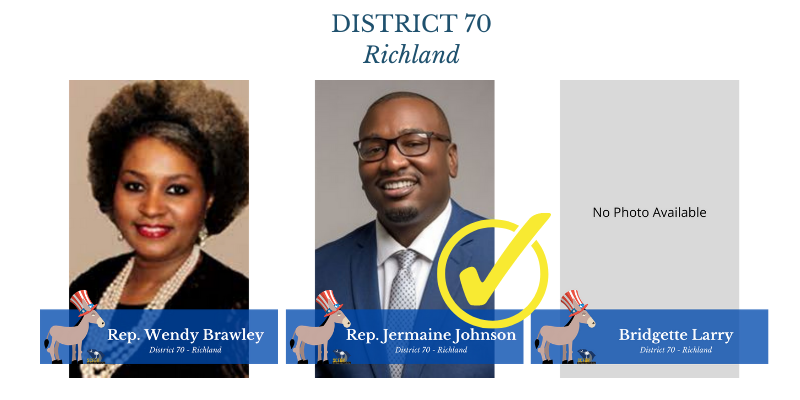

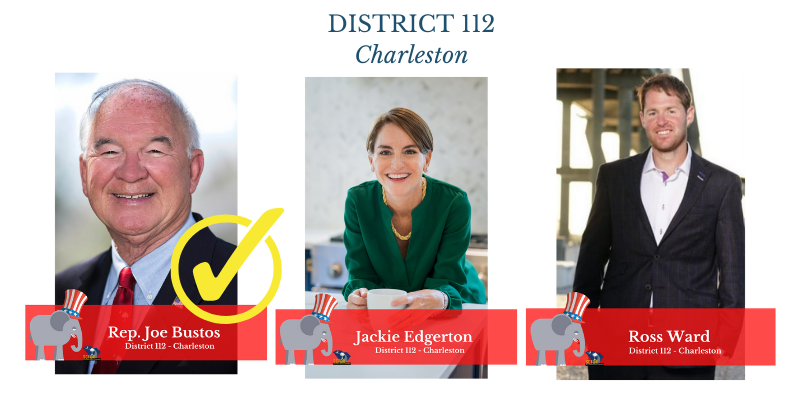

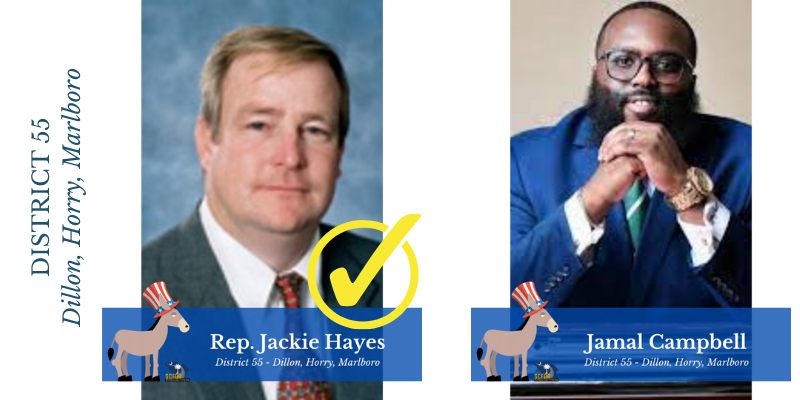

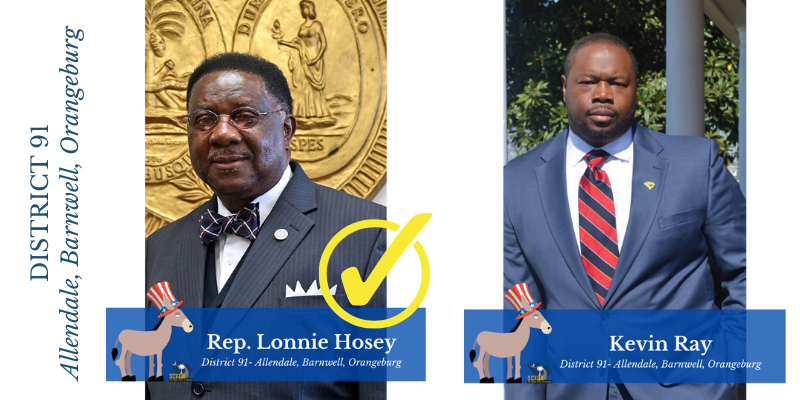

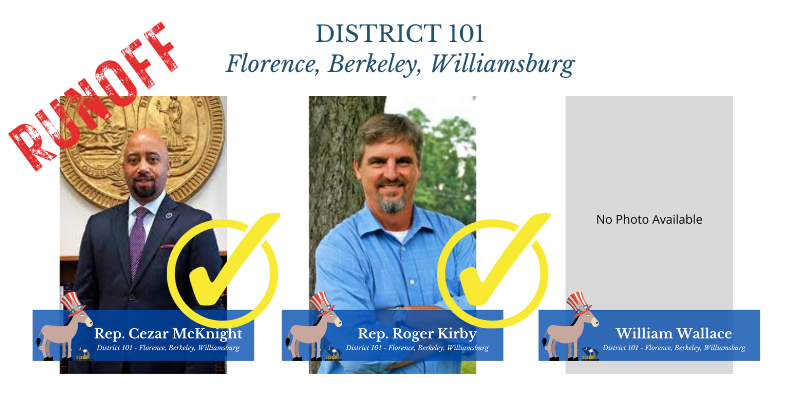

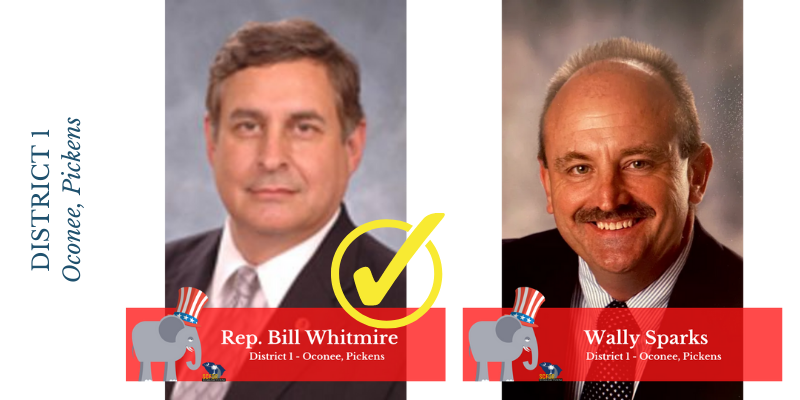

SCFOR tracked thirty-two (32) incumbent races in the June 14 Primary Elections for the SC House. These races covered the whole gamut this year, with long-serving members, House leadership, and newly elected members facing challengers. In all, a total of seven incumbents lost their seats:

- Rep. Rita Allison (R- Spartanburg)

- Rep. Lin Bennett (R-Charleston)

- Rep. Wendy Brawley (D-Richland)

- Rep. West Cox (R-Spartanburg)

- Rep. Vic Dabney (R-Kershaw)

- Rep. Rick Martin (R-Newberry)

- Rep. Brian White (R-Anderson)

A look at all incumbent races is illustrated below. A full tracking list for races for the SC House, Governor, US House, and US Senate can be found here.

Joe White won the Primary run-off for House District 60.

Roger Kirby won the run-off for House District 101.

Open Seats Closer to Being Filled, Runoffs and General Elections for Some

Following retirements and redistricting, there are 15 open seats in the SC House of Representatives. Ten (10) of those seats had primary races, and a few primaries in the open seats were a winner take all event, as the winners will not face opposition in November, including two candidates who ran unopposed in the Primaries.

- Republican Cody Mitchell ran uncontested to fill the seat held by the former Speaker, Rep. Jay Lucas.

- Republican Brandon Cox ran uncontested to fill the seat held by Rep. Joe Daning in Berkeley County.

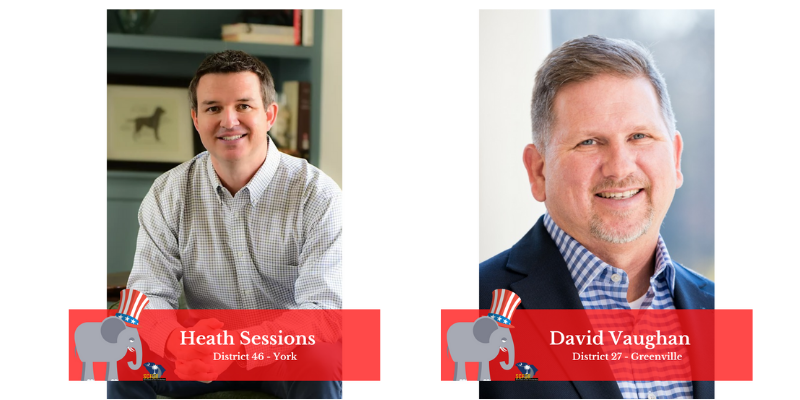

- Heath Sessions won the primary to fill the York County seat (Dist.46) currently held by Rep. Gary Simrill (retiring).

- David Vaughan won the primary to fill the Greenville County seat (Dist. 27) currently held by Rep. Garry Smith (retiring).

Official election results for all races can be found on the SC Election Commission website, click here.

*All candidate photos were sourced from the SC legislative website, legislative caucuses, campaign websites, and/or campaign-related social media pages. Some candidates did not have websites or social media pages for photos to be included in this report.

Suspension of Gas Tax Would be a Major Setback

Talks of suspending the gas tax have circulated at the federal and state levels among candidates and incumbents up for reelection. Meanwhile, leaders on both sides of the aisle have called out the idea of a suspension for what it is – a gimmick.

We’ve said it before, and we will say it again, suspending the state’s core revenue source used to repair, maintain, and improve our state’s roads and bridges is not the way to provide relief from record inflation and increasing fuel prices.

Proposals to suspend fees garner applause, likes, and shares, but ARTBA research has shown that any relief from gas tax suspensions is minor – with no guarantee that drivers will pay less to fill up.

Every year since the passage of Act 40 (2017), SCFOR has followed the retail price of gas at the pump on July 1. The price at the pump was consecutively lower than the previous year for five years. It wasn’t until 2021, as the nation was beginning to emerge from the pandemic that the retail price of gas was higher than the previous year.

Sure, it’s only two cents, but it is funny how even after a statutorily required increase occurs, the price at the pump didn’t budge two cents from the day or week before.

With that said, if South Carolina were to suspend the state’s total gas tax, there may be a tinge of relief, but is that relief noticeable – especially as prices continue to fluctuate on a daily/weekly basis? More importantly, is it worth setting the state back?

South Carolina waited 30 years to invest in our transportation infrastructure, and we have made great strides in tackling repairs since the passage of the road funding bill in 2017.

Everyone was thrown a curveball in 2020. South Carolina was fortunate that COVID didn’t set the state back, and the SCDOT was able to keep projects moving forward despite a decline in motor fuel revenue.

Canceling or suspending the state’s core funding mechanism for roads and bridges at such a critical time runs the risk of negating all of the progress to date – and it will bring the plans we’ve heard about for months to accelerate projects and expand upon the state’s 10-year plan to a halt.

Some politicians will use this as an opportunity to garner attention in an election year, while others sincerely want to alleviate the pain at the pump any way they can. The truth is, people still want their roads fixed, bridges repaired, and they are tired of sitting in traffic. ANY loss of revenue would have an adverse impact on the state’s ability to address these issues.

The pain at the pump is real. No one knows just how high prices will climb or how long this will last, which is why we cannot hold infrastructure hostage to factors beyond our control.

The best way to provide relief to South Carolinians is through sound public policies in the form of tax reductions and rebates that provide direct relief and benefit citizens long-term.

SCDOT Commission Approves Pavement Program

At the May meeting, the SCDOT Commission approved investment levels and ranked lists of projects for inclusion in the FY22-23 and FY23-24 pavement programs.

Approved Investment Levels

Thanks to the ongoing phase-in of state revenues from Act 40 (2017) and the recent passage of the federal Infrastructure Investment & Jobs Act (IIJA), peak investments are slated for FY22-23 and FY23-24.

A total of $769 million will be invested in the upcoming fiscal year (FY22-23)

- Interstates: $209 million

- Primary Roads: $325 million

- Farm-to-Market Secondaries: $148 million

- Neighborhood Streets: $87 million

A total of $775 million will be invested in FY23-24

- Interstates: $213 million

- Primary Roads: $327 million

- Farm-to-Market Secondaries: $148 million

- Neighborhood Streets: $87 million

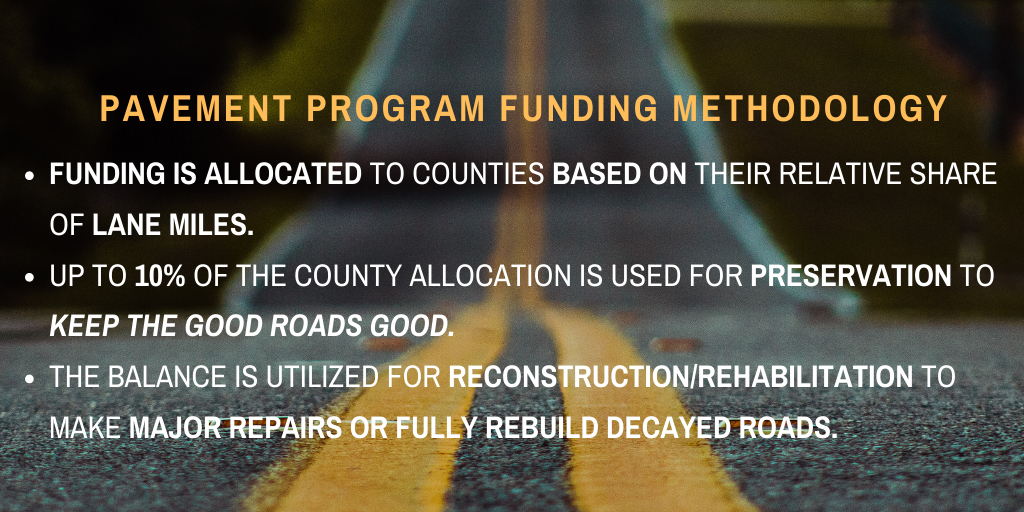

Funding for primary roads, farm-to-market secondaries, and neighborhood streets is allocated at the county level. These allocations are based on the county’s relative share of lane miles in each system.

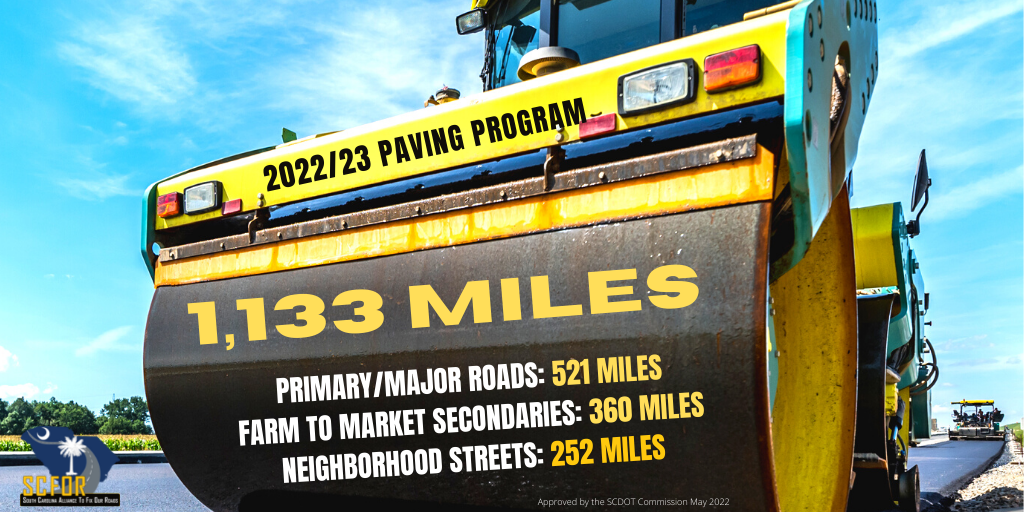

Approval of Ranked Projects

The Commission approved 1,133 miles of rehab/reconstruction projects for inclusion in the 2022-2023 paving program. Click here to view the complete list of the projects by county. The SCDOT also has an interactive map that shows the projects. Click here to view the map.

Commissioners also approved the 2023-2024 Primary/Major Roads (510 miles) ranked project lists for rehabilitation and reconstruction. Click here to view the FY23-24 Primary projects by county.

SCDOT is beginning to rank the Primary/Major Road projects on a two-year basis to provide visibility for contractors and local governments, so they know what is in the pipeline for planning purposes. The Farm to Market Secondaries and Neighborhood Streets will remain an annual listing, and SCDOT will present those projects to the Commission in May 2023.

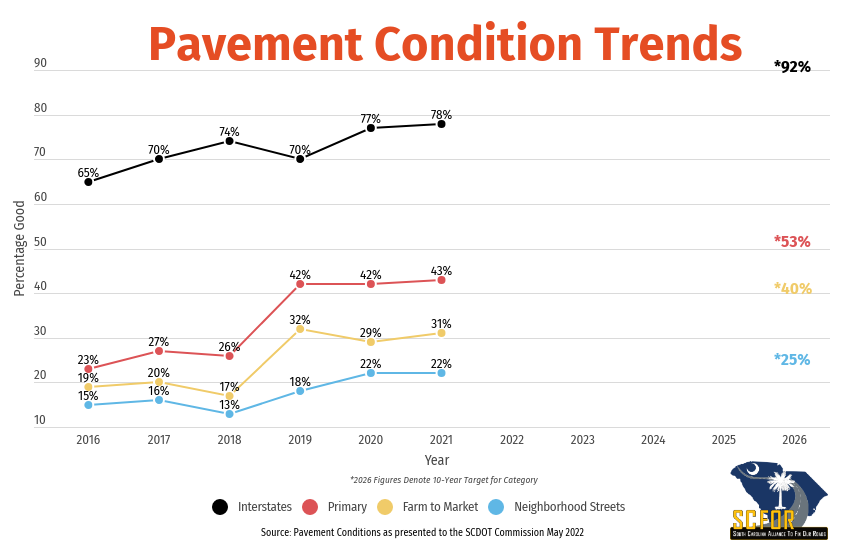

2021 Pavement Data

Progress continues on pavements statewide. Performance targets/goals for percentage good are higher on the roads that carry the most traffic.

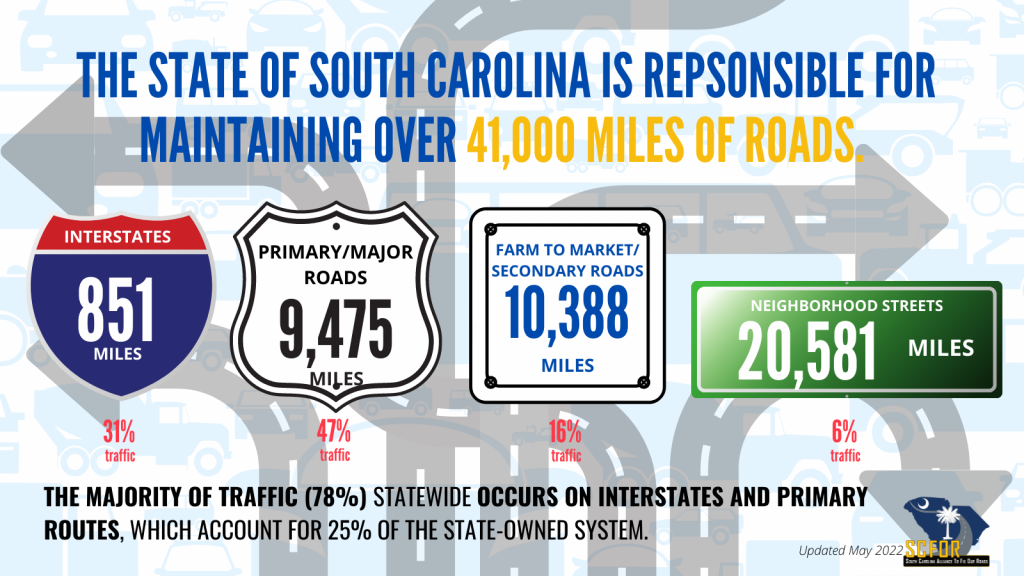

Remember, South Carolina is tasked with maintaining an extensive state-owned system – the 4th largest in the nation.

Interstates and Primary routes carry 78% of traffic, yet they only make up 25% of the state system. Neighborhood streets make up approximately 50% of the state system, but they only carry 6% of traffic.

South Carolina is putting your money to work!

These pavement projects will be added to over 5,800 miles of pavement improvements that have been initiated since 2017. None of which would be possible without the revenues generated by Act 40 (2017).*

*The final two-cent increase established by Act 40 goes into effect July 1, which will bring South Carolina’s motor fuel user fee to 28.75 cents per gallon. (The national average is 38.69 cents per gallon.)

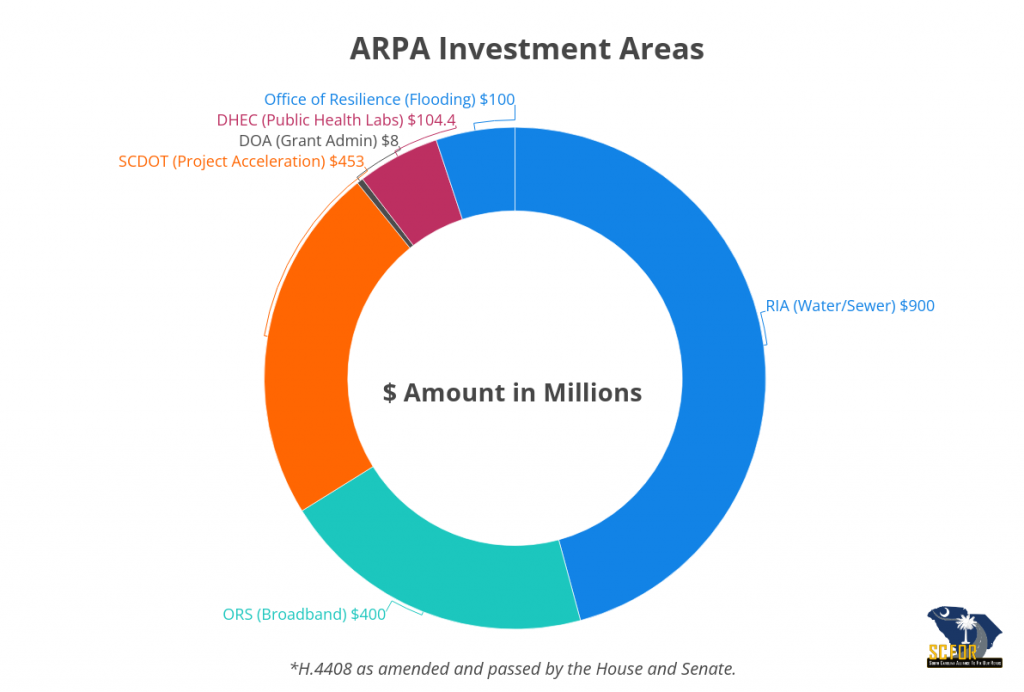

ARPA Dollars Fund Vital Infrastructure, Accelerate Interstate Projects

Governor Henry McMaster signed legislation (H.4408) dealing with American Rescue Plan Act (ARPA) fund allocations on May 13. These federal funds will go towards vital infrastructure needs across the state, including water/sewer, broadband, flood mitigation, public health, and roads.

When it comes to roads, $453 million will be allocated to a newly created “Transportation Infrastructure Acceleration Account” to accelerate projects in the pipeline.

Specifically, these dollars will be used to jump-start the widening of I-26 between Columbia and Charleston, a notoriously unreliable and dangerous section of interstate. (The SCDOT must submit plans to the Joint Bond Review Committee (JBRC) for review and approval before the Executive Budget Office (EBO) will release funds to begin work.)

This one-time boost of funding will provide fiscal capacity for the SCDOT to start the first two phases of the full widening of 1-26 between MM 125 to MM 194 and create financial capabilities in the program to accelerate additional phases so that construction can be initiated on the entire corridor by 2029.

We applaud the legislature and Governor for taking advantage of this unique opportunity to invest these one-time dollars in transportation infrastructure, which is critical to keeping South Carolina’s people and its economy moving forward. Thank you.

Just a little background: Closing the gap between Columbia and Charleston on I-26 and widening I-95 beginning at the Georgia state line were among the projects identified and ranked as part of the Rural Interstate Freight Network Mobility Improvement program approved by the SCDOT Commission in 2018. SCFOR continues to follow the FY22-23 budget deliberations, as any one-time allocations in the budget to rural interstate projects could go towards accelerating the I-95 project.

Fix for Local Road Fees Resides on House Floor

Legislation (S.984) to allow counties to continue imposing local service fees resides on the House floor. The bill passed the Senate last month and is an effort to end all uncertainty, and legal chaos since the Supreme Court ruled Greenville’s local road use and public safety fees invalid last year. (Burns V. Greenville County Council)

The bill codifies the elements for local fees established in Brown v. Horry County (1992) and removes the requirement that the fee benefits the payer differently from the general public. It also includes provisions to ensure that counties are not liable for paying out ten times the amount* and safeguards to ensure that counties who immediately repealed fees and increased taxes do not automatically re-impose fees.

The bill now moves to the House floor. We encourage members of the SC House to support passage of S.984. Otherwise, tax increases are imminent in most cases, and these increases will certainly pack a major punch if any of these lawsuits succeed.

*Some attorneys who have filed class-action suits against counties are using an obscure code section they believe entitles the plaintiffs to ten times the fees charged, which would require astronomical payouts in some instances depending on how long the local fees have been in place and how much was collected.

Senate Passes Budget, But Not Before Talking I-73 and Roads

Members of the Horry County delegation put in an all-out effort to include funding for I-73 in the Senate budget this week.

Republican Senators Luke Rankin, Greg Hembree, and Stephen Goldfinch offered numerous amendments throughout the day on Wednesday to include funding for the first segment of I-73.

Amendments ranged from allocating funds (the Senate reserved for their tax rebate) across infrastructure projects, including I-73, CTC acceleration, bridges, rehabilitation, etc. They also tried to entice Senators with a whole gamut of statewide needs, including raises for state employees, K-12 education, and the pension fund.

Late Wednesday evening, Senator Hembree made one last effort and asked his colleagues to adopt an amendment that would allocate $1 towards the project to give it one last chance during the budget conference committee. That amendment failed by a vote of 31-10.

While none of the amendments were adopted, the delegation’s efforts prompted discussion over the importance of funding infrastructure and the impacts that additional investments could make.

As we have previously reported, Senators incorporated their tax cut/rebate plan into their version of the budget, which left them with less money (approx. $1 billion) than the House when it comes to one-time allocations.

The budget will be returned to the House, and a conference committee will be appointed to reach a compromise on the spending plan in the coming weeks.

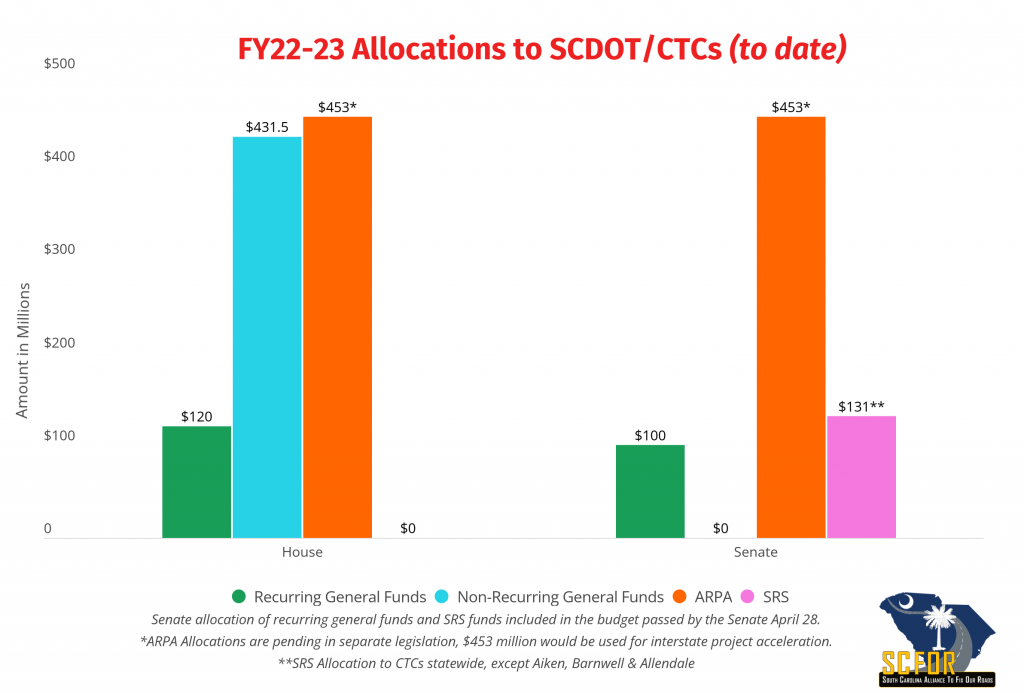

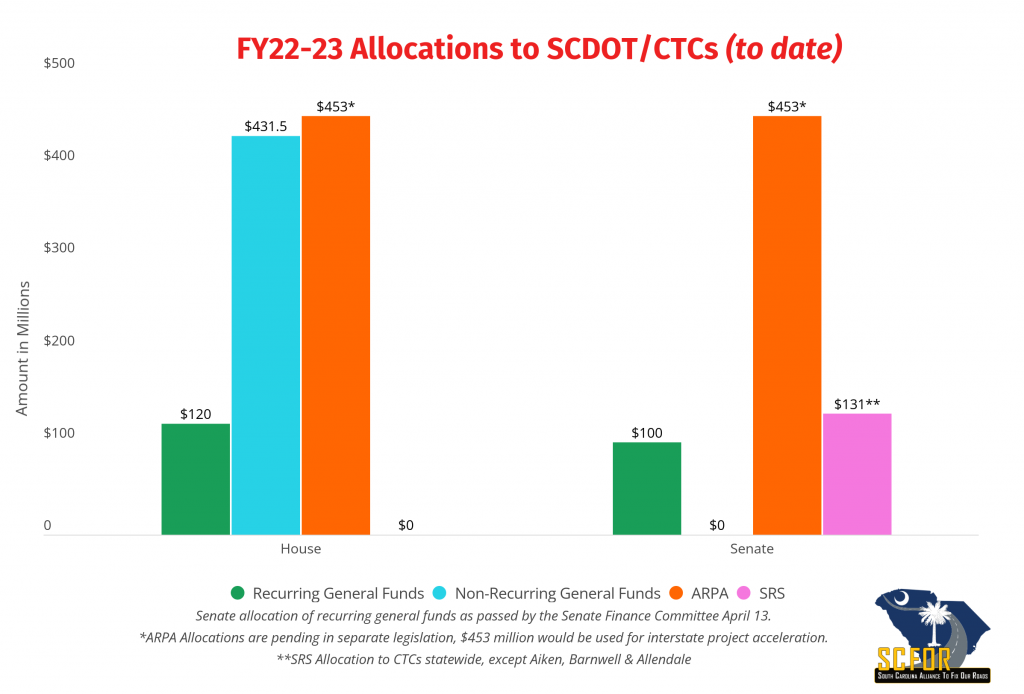

The good news is, both the House and Senate included recurring funds to SCDOT to serve as a match for federal dollars coming from the IIJA. These recurring dollars are vital to the continued success of the state’s 10-year plan and are critical for inclusion in the budget this year!

Senate Budget Deliberations Begin this Week

Senators will begin budget deliberations on the floor Tuesday, April 26. The Senate’s version of the FY22-23 budget takes into account the $2 billion income tax reduction/rebate plan* (S.1087), which unanimously passed the Senate last month. Roughly $1 billion of one-time surplus money will be used to cover the rebates included in the plan.

The Senate Finance Committee has included $100 million recurring dollars for SCDOT in their version of the budget. These dollars are critical as they will be used to match federal dollars from the Infrastructure Investment & Jobs Act (IIJA).

The IIJA funds will bolster the state’s 10-year plan by filling gaps in critical areas, including programs to address non-interstate congestion, closed and load-restricted bridges, traffic safety, and much more. There is a 4:1 return ratio on federal dollars – so this is an excellent opportunity to increase the buying power of our state dollars!

Senators also included their plans for the $525 million Savannah River Site (SRS) settlement in the budget. You will recall that they passed legislation (S.956) allocating those funds earlier this year, which included a $131 million allocation to the County Transportation Committees.

A comparison of allocations to transportation infrastructure in the House-passed budget and the Senate Finance plan is illustrated below.

The House and Senate budgets differ dramatically (not just for transportation but across the board) simply because each has incorporated respective tax plans into their budget proposals.

Remember, the House income tax plan** (H.4880) did not include rebates, so they had more money to work with for one-time allocations.

These pending tax plans will significantly impact the final version of the FY22-23 budget and will likely go hand in hand with budget negotiations between the House and Senate in the coming weeks.

SCFOR appreciates the work of the House and the Senate Finance Committee when it comes to making infrastructure investment a priority this year. SCFOR will continue monitoring budget negotiations and advocating for recurring dollars and one-time funding available to accelerate projects.

*The Senate tax plan reduces the top income tax rate from 7% to 5.7%, eliminates taxes on military retirement income, reduces industrial/manufacturing property taxes, and provides a one-time rebate for taxpayers. Rebates range from $100 to $700 to every person or married couple who files an income tax return.

**The House tax plan would condense tax brackets, reduce the 7% top rate to 6.5% and provide a phased-in reduction to 6% thereafter. (Each year, the top income tax rate will go down a tenth of a percent until it reaches 6%. However, if the state doesn’t grow at least 5% each year, those cuts won’t happen.)

Fix for Local Fees Passes Senate, Moves to House

A big victory for counties (and taxpayers this week) as legislation (S.984) to allow counties to continue to implement local fees passed the Senate by a vote of 32-7.

The bill’s primary sponsor, Senator Greg Hembree (R-Horry), introduced the bill in response to the Supreme Court decision that ruled Greenville’s local road use and public safety fees invalid last year. The bill codifies the elements for local fees established in Brown v. Horry County (1992) and removes the requirement that the fee benefits the payer differently from the general public.

Senator Hembree and others contend that existing statutes providing counties the authority to impose fees and the Brown case were consistent, but the Supreme Court ruled otherwise. Therefore, it was up to the legislature to clarify and fix.

Since the Supreme Court decision last year, numerous class-action lawsuits have been filed. We appreciate Senator Hembree’s accurate summary of what is going on with these lawsuits: “You’ve got taxpayers, suing taxpayers, to pay taxpayers.”

The revenue impacts would differ in dollars and percentage of the annual budget depending on the county. However, in most cases, the absence of fees would force counties to increase property taxes. In addition to the fiscal impact of the fee’s absence on local road programs, there would also be detrimental effects on budgets should counties be forced to pay out on some of these lawsuits.

Senator Tom Davis (R-Beaufort) was instrumental in ushering the bill through this week. He chaired the Finance Subcommittee that heard testimony on the bill and fully understands that these local fees help provide vital services. And when it comes to road fees, they cover the cost of everything from minor repairs to helping fund major local projects.

Amendments were adopted to address concerns regarding liability for lawsuits and fears counties that dropped their fees and increased property taxes would re-impose fees.

The bill now moves to the House of Representatives – and needs to pass this year!

There seems to be some confusion that this bill is a green light to raise taxes when in fact, it’s quite the opposite. As we noted, in most cases, the absence of fees would force counties to increase property taxes – and there’s no telling what would need to be done if these class-action lawsuits are successful as the payouts would be astronomical in some cases.