Senators will begin budget deliberations on the floor Tuesday, April 26. The Senate’s version of the FY22-23 budget takes into account the $2 billion income tax reduction/rebate plan* (S.1087), which unanimously passed the Senate last month. Roughly $1 billion of one-time surplus money will be used to cover the rebates included in the plan.

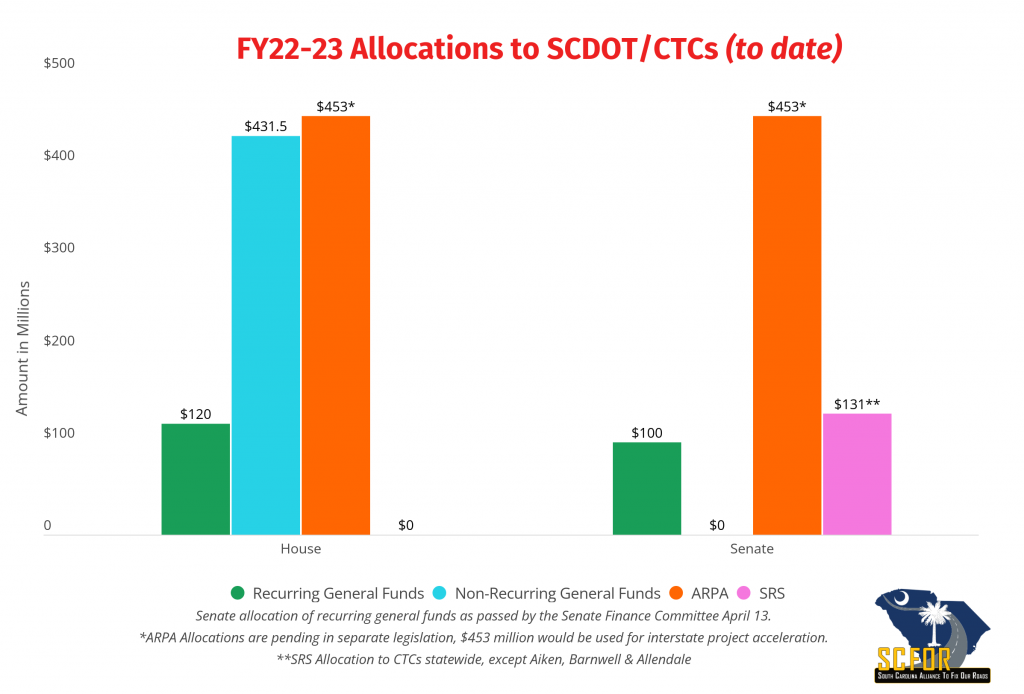

The Senate Finance Committee has included $100 million recurring dollars for SCDOT in their version of the budget. These dollars are critical as they will be used to match federal dollars from the Infrastructure Investment & Jobs Act (IIJA).

The IIJA funds will bolster the state’s 10-year plan by filling gaps in critical areas, including programs to address non-interstate congestion, closed and load-restricted bridges, traffic safety, and much more. There is a 4:1 return ratio on federal dollars – so this is an excellent opportunity to increase the buying power of our state dollars!

Senators also included their plans for the $525 million Savannah River Site (SRS) settlement in the budget. You will recall that they passed legislation (S.956) allocating those funds earlier this year, which included a $131 million allocation to the County Transportation Committees.

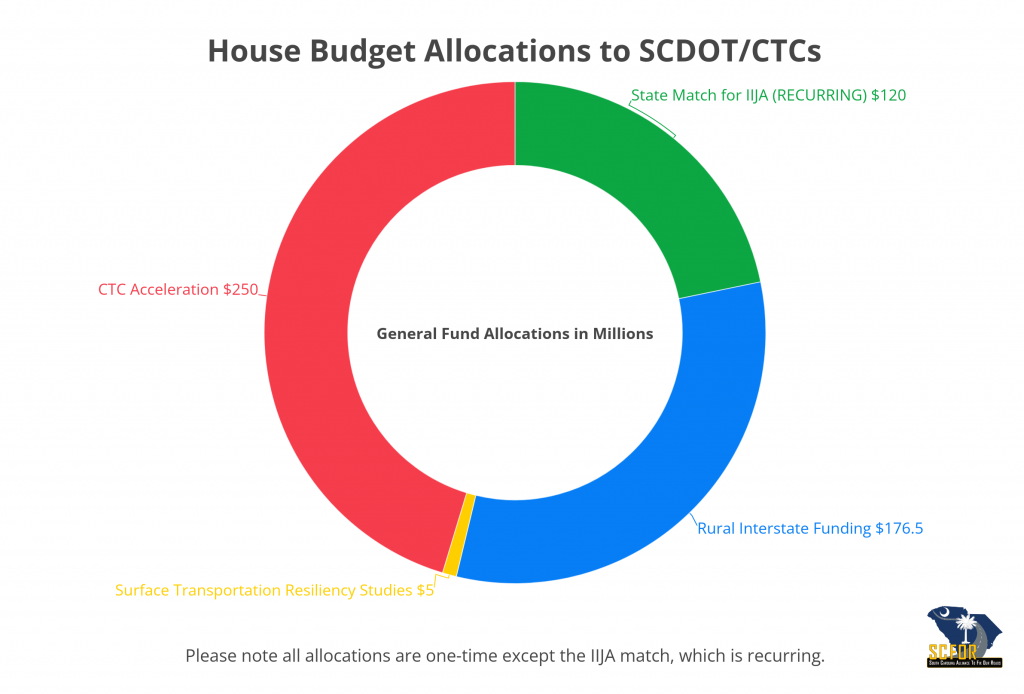

A comparison of allocations to transportation infrastructure in the House-passed budget and the Senate Finance plan is illustrated below.

The House and Senate budgets differ dramatically (not just for transportation but across the board) simply because each has incorporated respective tax plans into their budget proposals.

Remember, the House income tax plan** (H.4880) did not include rebates, so they had more money to work with for one-time allocations.

These pending tax plans will significantly impact the final version of the FY22-23 budget and will likely go hand in hand with budget negotiations between the House and Senate in the coming weeks.

SCFOR appreciates the work of the House and the Senate Finance Committee when it comes to making infrastructure investment a priority this year. SCFOR will continue monitoring budget negotiations and advocating for recurring dollars and one-time funding available to accelerate projects.

*The Senate tax plan reduces the top income tax rate from 7% to 5.7%, eliminates taxes on military retirement income, reduces industrial/manufacturing property taxes, and provides a one-time rebate for taxpayers. Rebates range from $100 to $700 to every person or married couple who files an income tax return.

**The House tax plan would condense tax brackets, reduce the 7% top rate to 6.5% and provide a phased-in reduction to 6% thereafter. (Each year, the top income tax rate will go down a tenth of a percent until it reaches 6%. However, if the state doesn’t grow at least 5% each year, those cuts won’t happen.)