State law requires that the new revenues generated from the 2017 road funding law be deposited into the Infrastructure Maintenance Trust Fund (IMTF). The most recent statement can be viewed here.

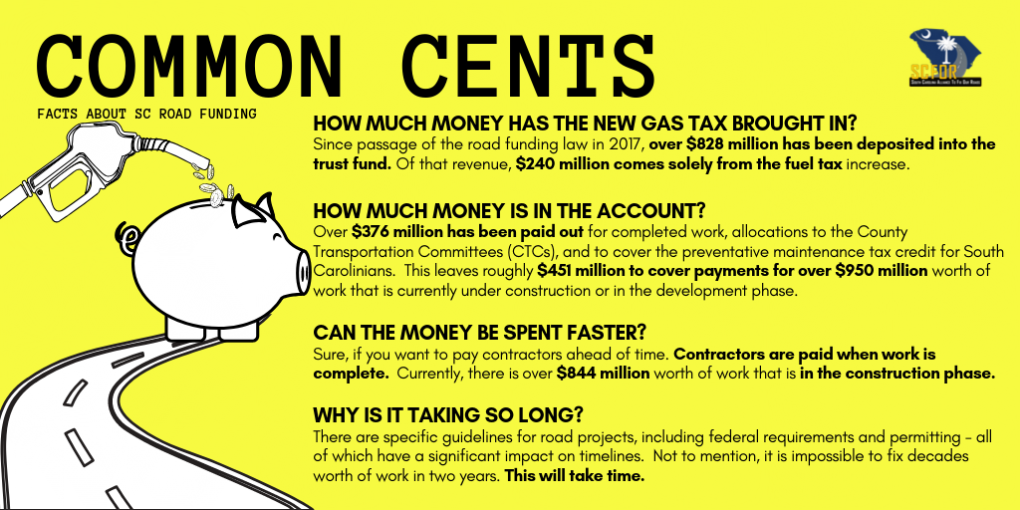

The latest data shows that since the passage of road funding legislation in 2017, over $828 million has been deposited into the IMTF. Of that, $240 million comes from the fuel tax increase. Currently, the most significant source of revenue in the IMTF comes from the infrastructure maintenance fee (formerly the vehicle sales tax); however, that is likely to shift as the extra pennies are phased in on fuel.

Since 2017, over $376 million has been paid out for completed work, allocations to County Transportation Committees (CTCs), and to cover the preventative maintenance tax credit for South Carolinians.

There is a lot of misinformation out there that implies that the money is being diverted elsewhere. The truth is, the only “diversion” is one that goes back into the pockets of SC taxpayers. Moreover, if money remains in the tax credit account after tax credits are claimed, it must go back to SCDOT to be used to fix roads and bridges.

Thanks to the 2017 road funding law, additional revenues will continue to be phased in the coming years. It is because of these revenues that South Carolina has been able to adequately plan and ensure that EVERY county in South Carolina sees benefits.

Over $1 billion in project commitments have been made to improve over 3,000 miles of pavements, bridges, and safety improvements in ALL 46 counties. View the list here.

Our roads and bridges didn’t get in this condition overnight, and there’s no quick fix. The good news is, there is a plan in place to address long overdue improvements to pavements, bridges, and safety. We plan to continue to follow the progress and look forward to seeing more work hit the streets. We encourage you to follow it with us!