The motor fuel user fee (aka “the gas tax”) has been, and continues to be, the predominant source of state funding for our roads and bridges. Prior to Act 40 of 2017, the motor fuel user fee was among the lowest in the nation and had not been adjusted since 1987.

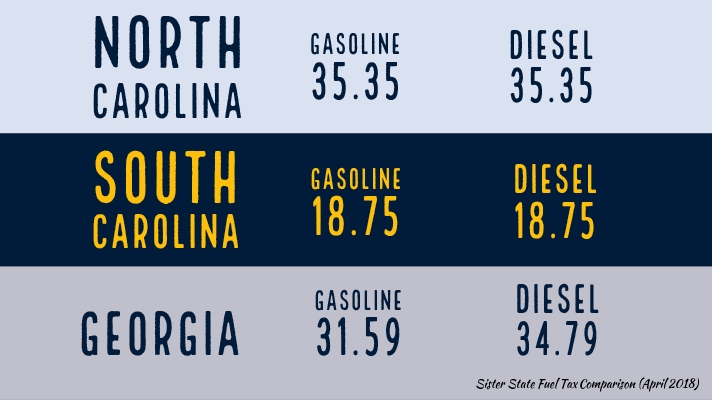

Act 40 increased the fee by 12 cents per gallon, which is phased-in by 2 cents annually over a 6-year period. Currently, drivers who fill up in South Carolina are paying 18.75 cents per gallon. (This rate will increase to 20.75 cents per gallon on July 1, 2018 and will continue to increase annually by two cents until it reaches 28.75 cents in 2022.)

For comparison, here’s how much you’d be paying in state fees on fuel in our sister states – which ironically enough, have better roads than us.

All of the money from the increase in the motor fuel user fee goes directly to the infrastructure maintenance trust fund, which “must be used exclusively for the repairs, maintenance, and improvements to the existing transportation system.”

This fund serves as a lockbox to ensure the revenues are used solely on improvements to the existing system.

South Carolina taxpayers are eligible for an income tax credit to offset the increase in the motor fuel user fee. The SC Department of Revenue’s website offers more information on eligibility and how to claim this tax credit.