The SCFOR Annual Meeting was held on Thursday, November 2. SCFOR Chairman Jim Thompson (Martin Marietta) kicked off the event by welcoming a sold-out crowd to the Hall at Senate’s End. Thompson reiterated the importance of transportation infrastructure to the state’s overall economic competitiveness and SCFOR’s ongoing efforts to educate the public and policymakers on the need for safe and efficient infrastructure.

South Carolina continues to attract people and new businesses. We have seen record economic development announcements over the past year, and it’s true – the state’s economy is booming.

It is an exciting time here in South Carolina, and as everyone knows, significant progress has been made since 2017, and there is much work to be done. Ongoing population and economic growth will continue to impact our infrastructure at the state and local levels. Our annual meeting served as an opportunity to bring together state and local leaders to connect the dots on all things infrastructure.

SCDOT Progress Report

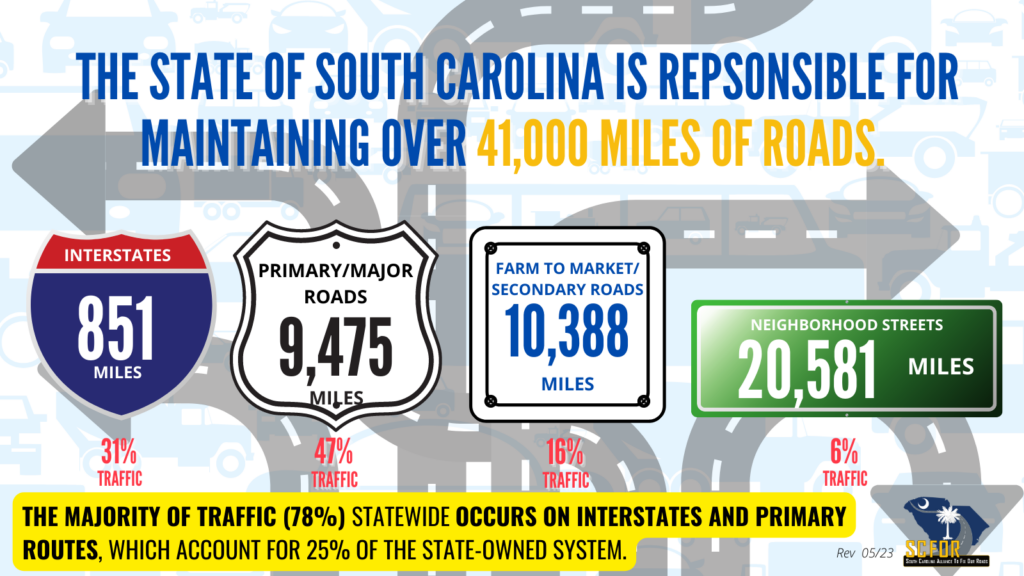

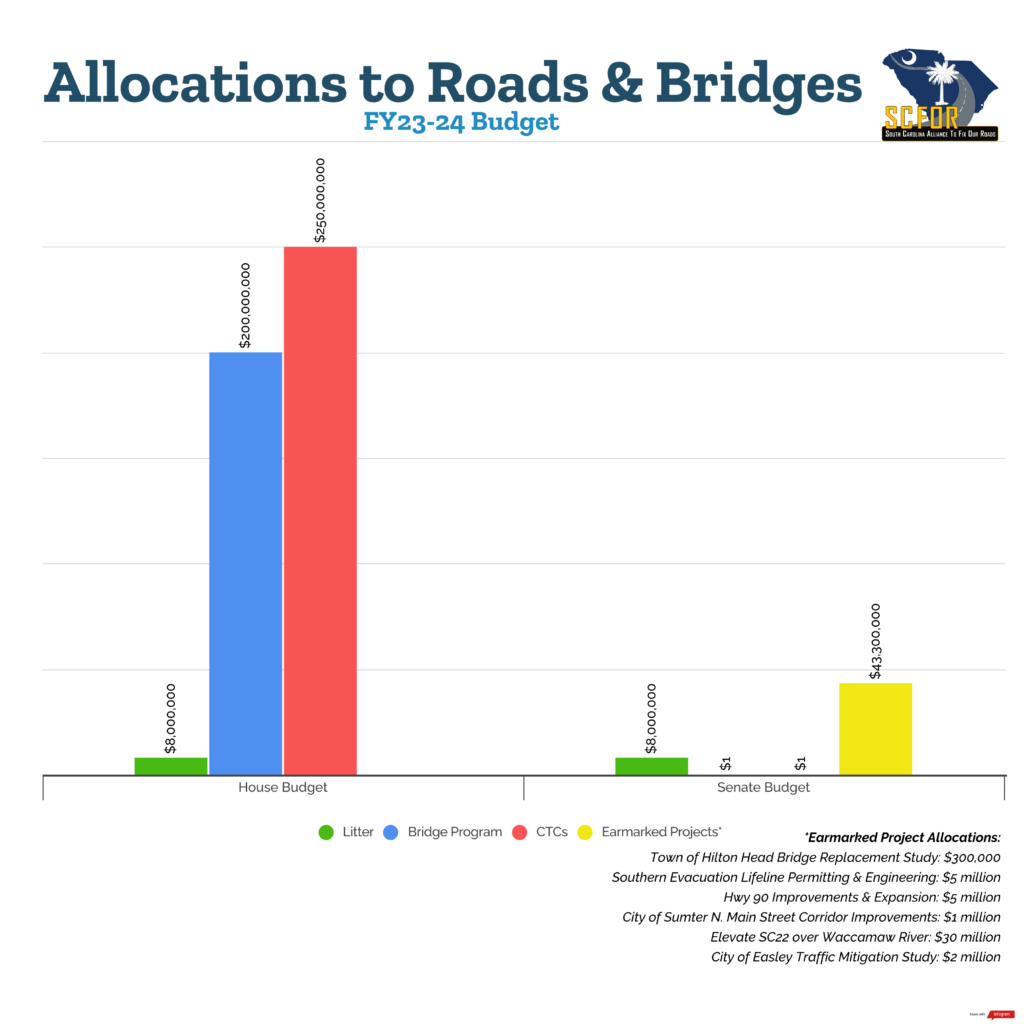

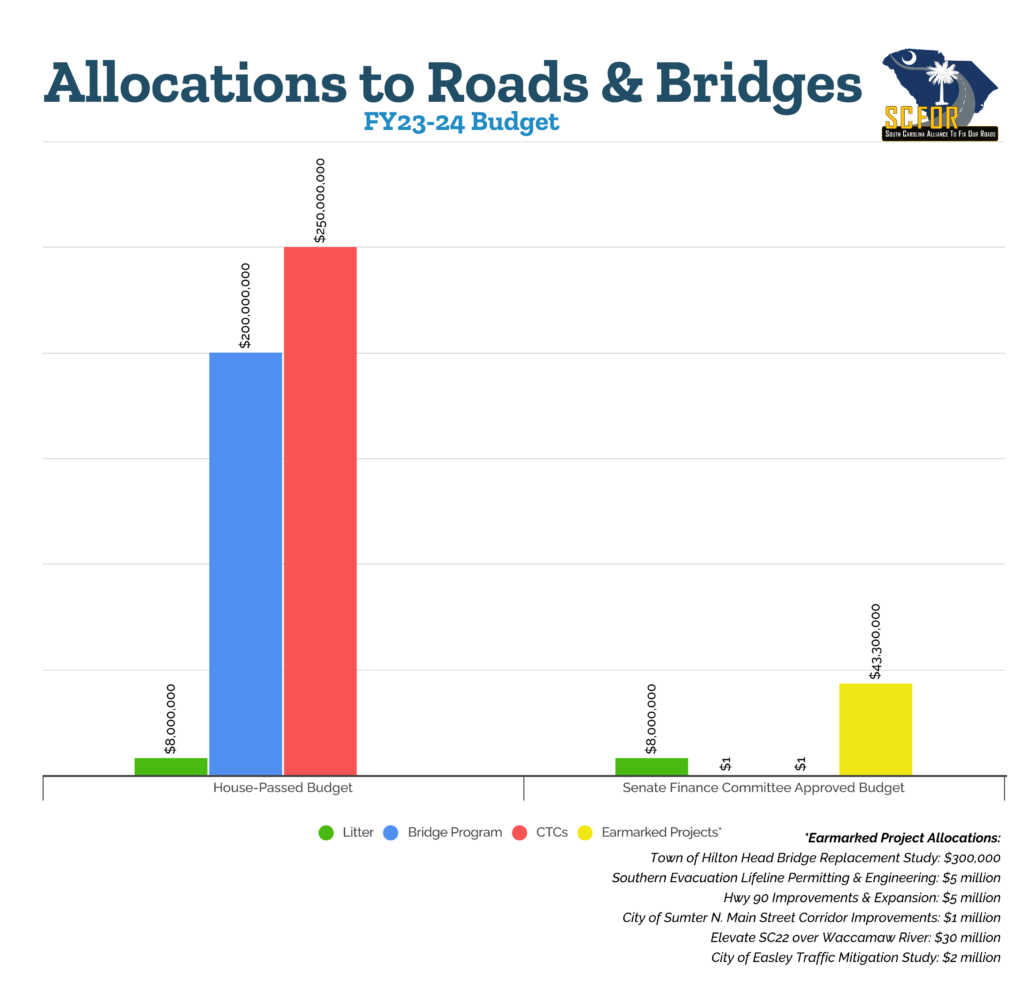

SCDOT Commission Chairman Tony Cox provided us with a Commissioner’s perspective of the SCDOT before introducing Secretary of Transportation Christy Hall. Secretary Hall provided a thorough update on how the agency is working to meet the needs of our growing state, progress to date on the 10-year plan, and emphasized the need for additional resources to address a “looming bridge crisis.”

A growing number of bridges in the state’s network are reaching an age where repairs or replacements are necessary. Secretary Hall renewed her request for the legislature to allocate general funds to the SCDOT’s bridge program, specifically $200 million to address bridges on interstates, primary, and secondary routes.

SCFOR appreciates all of the SCDOT leadership and SCDOT Commissioners who took the time to join us!

Legislative Panels

Representatives Gary Brewer (R-Charleston), Cody Mitchell (R-Darlington), Russell Ott (D-Calhoun), and Jay West (R-Anderson) offered insights on navigating the legislative process in the House, issues they are working on, and what they expect in the upcoming 2024 session.

Senators Thomas McElveen (D-Sumter), Ross Turner (R-Greenville), and Tom Young (R-Aiken) gave perspectives on the budget process and touted the importance of continuing to assess issues related to infrastructure needs, workforce development, and safety.

The legislature has done a great job of making additional investments, most recently in 2022, with a significant allocation of one-time dollars to accelerate interstate expansion and a general fund allocation to help match new federal dollars.

Our mission is to ensure they remain proactive about addressing infrastructure needs, continue to assess the buying power of dedicated funding mechanisms, address electric vehicles, and allocate general fund dollars when available.

Local Government Funding: Progress with Pennies

Local governments are responsible for essential services affecting citizens’ day-to-day lives, from public safety and education to water and sewer. They also play a critical role in tackling transportation infrastructure issues, and one of the ways they can do this is through local option sales taxes at the county level.

We were fortunate to learn from Horry and Dorchester Counties about their respective taxes and how they have successfully implemented these programs more than once.

Horry County Administrator Steve Gosnell, PE, and RIDE Program Manager Jason Thompson, PE, shared some great information on how Horry County has been able to put their capital project sales tax to good use over the years and their plans for the future to renew their penny to address new projects.

Jason Carraher, PE, Dorchester County Public Works Director, and Todd Friddle, Dorchester County Council Chairman, discussed how their rapidly growing county put the first transportation sales tax to work and shared plans for the future under the recently renewed (2022) transportation tax.

Both counties agreed that public education is critical, not just to get programs approved at the ballot box but ongoing education and reminders about the progress and projects underway.

SCDOT Bridge Program

Bridges usually don’t get the attention they deserve from the general public because it isn’t until a bridge is closed for repairs that people realize a bridge is more than just pavement. These structures are key connectors for communities and commerce.

We closed the day with a timely presentation by Rob Perry, PE, SCDOT’s Chief Engineer for Bridges, who provided a thorough overview of how the bridge office is working to tackle maintenance and replacements to an aging bridge network.

There are 8,442 bridges in the state system. Approximately 32% (2,751) of these bridges are 60 years old, and 1,145 bridges are over 75 years old.

To tackle these structures, the Bridge office is looking at low-volume bridge design criteria, pursuing federal grants, and a general fund allocation.

We appreciate the support of all of our sponsors! This event would not have been possible without your generous support, so THANK YOU!